salt tax cap mortgage interest

The rich especially the very rich. In fact the Congressional Budget Office estimated.

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

What counts Before the 2018 tax year homeowners getting a new mortgage were allowed to deduct interest paid on loans of up to 1 million secured by a principal residence or second home.

. The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 1 million of mortgage debt. Your only income comes from your S-Corp. Annual vehicle registration fee for new truck.

A penalty for workers living in high cost high productivity areas. Limiting the two provisions helped broaden the tax base offsetting tax revenue loss from reduced tax rates. Ergo any SALT payments in excess of the 10000 threshold become ineligible for deduction on federal tax returns.

New Tax Law on SALT. Today the limit is 750000. This was true prior to the SALT deduction cap and remained the case in 2018.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. The state and local tax SALT deduction and the home mortgage interest deduction MID. 14000 of mortgage interest.

Another proposal is to increase the cap on the SALT deduction to 15000 for individual filers and 30000 for joint filers. For simplicity in these examples lets assume that you file a joint tax return with your spouse that your federal tax rate is a flat 30 and that the NY tax rate is a flat 685. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers. The federal tax reform law passed on Dec. 1 day agoOne of the benefits of buying a home is the home mortgage interest deduction.

15 2017 can deduct interest on the. Few federal taxpayers may cry tears for the Manhattan resident who can barely afford a 3000 studio. The limitations are slated to expire at the end of 2025 but.

The proposed increased limit on the SALT cap or the maximum deduction that families can take for their payments of state and local taxes could be in jeopardy as the Build Back Better bill stalls in the Senate. Various changes made it more difficult to itemize and therefore more difficult to deduct mortgage interest. This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill.

Capping the SALT deduction also exacerbates a well-known problem in the federal tax code. The SALT deduction tends to benefit states with many higher-earners and higher state taxes. For many couples the increase in the standard deduction will cancel out the benefit of itemizing since their mortgage interest and 10000 SALT deduction combined wont exceed 24000.

The mortgage interest tax deduction allows homeowners to deduct from their taxable income some or all of the interest they pay on a qualified home mortgage loan. The TCJA also made it harder for homeowners to maximize the mortgage interest tax deduction by limiting the deduction for state and local income taxes SALT to 10000 when there was previously. 54 rows In 2018 only 321 percent of those filers itemized.

Sales tax paid on new truck. Two major provisions in the federal tax code have been limited since the Tax Cuts and Jobs Act TCJA of 2017. Along with the mortgage interest deduction the non-taxation of employer-sponsored health benefits and pension benefits preferential tax rates on capital gains and the tax deferral of corporate profits earned abroad the SALT deduction costs the federal government trillions in missed revenue opportunities.

52 rows The deduction has a cap of 5000 if your filing status is married filing separately. Jeff will be able to deduct 5775 3000 2500 275 on Schedule A. But remember that Jeffs standard deduction is 12200.

That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a mortgage if single a joint filer or head of household while married taxpayers filing separately can deduct up to 375000 each. You can deduct mortgage interest on the first 750000. However there are a few exceptions.

It merely reallocates the tax burden from federal to state and local governments. That limit applies to all the state and local. The expansion of the standard deduction further limited the value of the SALT deduction for taxpayers under the 10000 cap.

15000 of real estate taxes. Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut. During the year you paid.

This was due not only to the. The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017. As a result the percentage of taxpayers claiming the deduction fell by nearly two-thirds while the average amount claimed fell by 80 percent.

Homeowners who bought houses after Dec. The change may be significant for filers who itemize deductions in high-tax states and. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly.

Also deduction for mortgage interest was truncated under the new law. The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately. Under the new tax laws SALT deductions are limited to an aggregate of 10000 for joint filers.

Among the the many provisions on the bill that would help middle- to upper-income families the BBB proposed a 70000 increase in SALT deductions. Remember that he can deduct either state and local income taxes OR sales tax not both. 2000 of charitable contributions.

My Real Estate Office In Birmingham Michigan Paul Mychalowych Broker Owner Real Estate Office Estates Real Estate

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

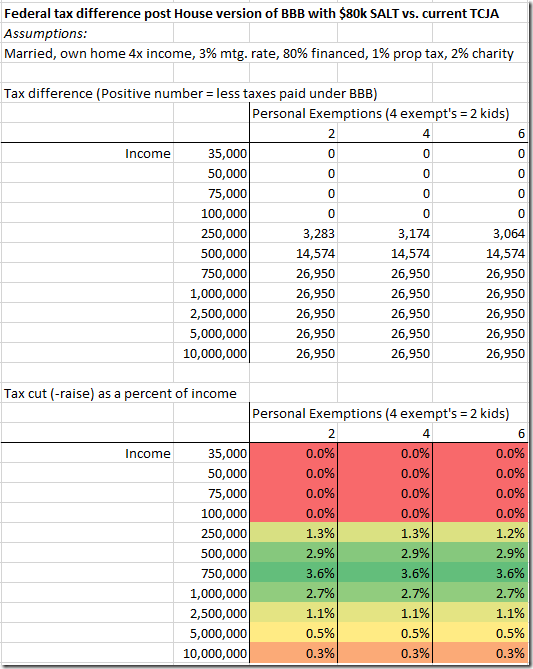

Our Analysis Of The 80k Salt Deduction Increase In The House Bbb Bill Spreadsheetsolving

Salt Deduction Cap Was Part Of A Package Wsj

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

My Real Estate Office In Birmingham Michigan Paul Mychalowych Broker Owner Real Estate Office Estates Real Estate

Majority Of Homeowners And Renters Benefiting From The Tax Cuts And Jobs Act John Burns Real Estate Consulting

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

State And Local Tax Salt Deduction Salt Deduction Taxedu

Looking For A Lower Mortgage Payment Mortgage Payment South Valley Home Buying

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget